Nurses’ union report criticizes Ascension heath system for investments against Catholic values

(RNS) — A nurse’s union report says American Catholic health care giant Ascension has invested hundreds of millions of dollars of its pension fund in industries the union says are contrary to Catholic teaching.

On Monday (Sept. 15), at a rally for Baltimore nurses who are in contract negotiations with Ascension, National Nurses United plans to release the report alleging Ascension Master Pension Trust’s investments in weapons manufacturers, military contractors, mining companies, fossil fuels and other companies are at odds with Catholic values.

NNU leaders say the report illustrates that Ascension has resources it is not investing in its Baltimore hospital. Robin Buckner, a vascular access nurse who has worked at Ascension’s St. Agnes Hospital in Baltimore for about a decade, said the report backs up the nurses’ claim that Ascension should put its resources to better use.

“ That money could be used for the patients and the staff,” said Buckner, who is not religious, referring to Ascension’s mission statement committing to “serving all persons with special attention to those who are poor and vulnerable.”

Ascension’s investment practices have come under scrutiny before, especially its partnership with private equity firm Towerbrook Capital Partners, through which it invested $200 million into a medical debt collection company that had previously faced an investigation by the Minnesota attorney general for aggressive and allegedly illegal collection practices. An investigation from Stat reported the tax-exempt health system is “moonlighting as a private equity firm.”

In July, NNU nurses at Saint Agnes held a historic one-day strike following more than a year and a half of contract negotiations. They say Ascension has refused to meet their demands, including ensuring safe nurse-to-patient staffing ratios, requiring appropriate nurse assignments based on expertise, and enacting a policy prohibiting patient assignments to charge nurses.

Buckner said she has seen the negative impact of inadequate staffing on her own team, which places IVs and central lines, on delays in patient care. Sometimes, she said, “ we come in in the morning to see the patient, you know, to start our day, and this patient has been waiting from last night to get IVs, who has had a delay in care.”

The NNU report relies on public disclosures for calendar year 2023. Only a sliver of Ascension’s investments are available to the public because federal law requires the disclosure of certain information about pension plans. Another of Ascension’s investment arms, Ascension Investment Management, manages over $40 billion in an Alpha Fund, which has outside investors, and those investments are not public.

Nate Johnson, a research analyst for NNU, said the union was motivated to pursue the report after Ascension’s fossil fuel investments were highlighted in a report by Climate Safe Pensions, which argued that “human-driven climate change is the most existential threat to the health and wellbeing of humanity.”

Ascension’s leadership has argued it is a “leader in transitioning from fossil fuels.” But Johnson said its 2023 portfolio had stocks in oil companies it could easily trade.

NNU also reports investments in weapons manufacturers; military contractors, including one found liable for contributing to torture; pharmaceuticals; alcohol producers; tobacco companies; gambling companies; apparel companies criticized for their labor practices; mining companies; big banks with carbon-intensive investments; oil and gas companies; and food and beverage conglomerates, including fast food companies. The pension fund also had more than half a million dollars invested in Philip Morris International, the tobacco company behind Marlboro, and the report totals more than $2 million in tobacco companies.

“On the most basic level, why are they invested in tobacco companies? They’re a health care institution,” Johnson said.

Clemens Sedmak, a professor of social ethics at the University of Notre Dame, said in an email the allegations in the report are “pretty alarming from a moral and theological perspective.”

“Why maximize the return on investment at costs that are not morally justifiable?” he asked.

Sedmak said the principle of non-maximization is important in both Jewish and Christian traditions, which includes observing a non-productive Sabbath, supporting laws and investments that are pro-poor, and promoting the idea of temperance. He added, “Catholic institutions can be held to explicit — and let us say, higher — moral standards because of the moral claims and teachings of the church.” He also noted Pope Francis had called for “a new culture of transparency, especially in financial matters.”

The report calls on Ascension to annually disclose its investment holdings; divest from fossil fuels, weapons, mining and other extractive industries; and publicly disclose its most updated socially responsible investment criteria.

While NNU has been a particularly vocal critic of Ascension, concerns about its decision-making continue to emerge from other stakeholders.

Last month, the Milwaukee Journal Sentinel reported that in Wisconsin, Ascension plans to outsource its intensive care unit staffing to a private equity-backed firm. Local doctors and nurses told the Sentinel they were worried patient care would suffer from a decision one doctor characterized as “choosing the cheapest model possible.”

Some of the smaller hospitals in Wisconsin would move to an “electronic ICU” model where there is no critical care physician present, but someone is available virtually. One nurse said she was concerned no doctor would be present with the necessary experience to intubate a patient or insert a chest tube for someone with a collapsed lung.

The Archdiocese of Milwaukee did not respond to multiple requests for comment on that decision.

Ascension did not respond to an RNS request for comment on staffing decisions in Wisconsin or the forthcoming NNU report criticizing their investments.

In past years, news reports have described other concerns about Ascension, including that it has closed hospitals in low-income communities and reduced staffing to improve profitability at the expense of patient safety.

To create the report, NNU relied on two documents: the U.S. Conference of Catholic Bishops’ 2021 Socially Responsible Investment Guidelines and “Mensuram Bonam” Faith-Based Measures for Catholic Investors: A Starting Point and Call to Action, a 2022 document from the Pontifical Academy of Social Sciences.

Sedmak pointed to several papal teachings that should shape Catholic investing, including Francis’ warning in the 2023 apostolic exhortation “Evangelii Gaudium” that says “the current (societal) model with its emphasis on success and self-reliance does not appear to favour an investment in efforts to help the slow, the weak or the less talented to find opportunities in life,” and the call of the 2015 papal encyclical “Laudato Si’” to care for the environment.

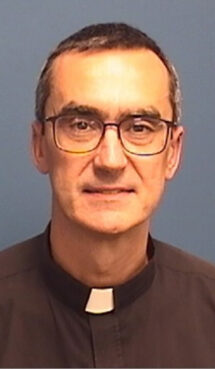

The Rev. Pedro McDade, a Jesuit who previously worked in banking at Santander and Barclays, said Catholic institutions should take into consideration the USCCB’s investing guidelines and “Mensuram Bonam” because “they are all attempts to make more concrete, general principles around the following of Christ.”

The assistant professor of philosophy at Saint Louis University said Catholics should review their investments within the examination of conscience that comes before confession. And, they should generally avoid investments in weapons or environmentally unfriendly activities.

McDade, who did not review the report, said investing is related to the theological virtue of hope practiced by pilgrims, especially in the Jubilee year, and “the idea of a sacrifice that you make on the short term to purchase something with the hope of acquiring a greater benefit.”

“ We walk in this world surrounded by material goods in the hope of coming into communion with eternal good, which is communion with Jesus,” he said.

Source link