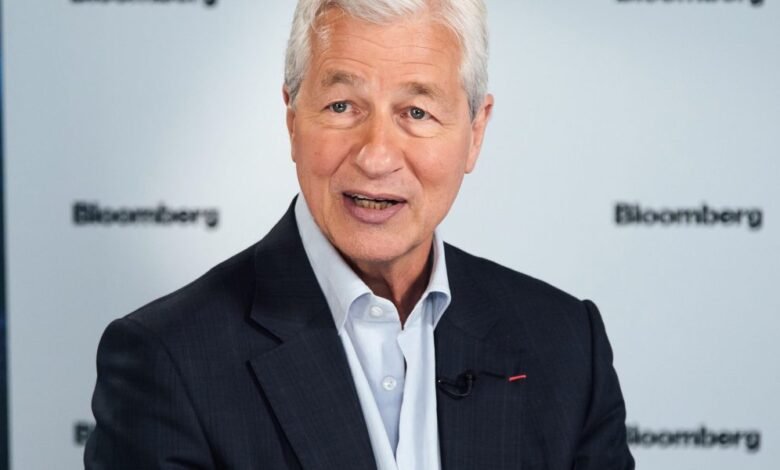

Jamie Dimon takes a stand by signing JPMorgan up as the first big bank to reveal a key clean energy metric to investors

The dean of Wall Street CEOs is green. JPMorgan Chase today struck an agreement with three New York City pension funds with investments in the bank valued at $478 million to disclose the ratio of its clean energy to fossil fuel financing. According to the NYC funds, the metric will give investors a more comprehensive view as to how the bank is progressing on its net-zero emissions goals and whether it is ratcheting up its clean-energy financing activities over time.

JPMorgan’s settlement with the three NYC funds, which manage a combined $193 billion in assets, will result in the withdrawal of their shareholder proposal, which they have levied against six major banks. It makes JPMorgan the first of these banks to strike a deal with investors. The others—Bank of America, Citigroup, Goldman Sachs, Morgan Stanley, and Royal Bank of Canada—still have proposals pending and the NYC Comptroller’s office has been engaging with them. The pension funds in January announced that they were launching the drive to prod the banks to offer up more data on their climate transition commitments.

Bloomberg New Energy Finance research found that in order for average global temperature increases to remain below 1.5 degrees Celsius, which is optimum, the ratio of investments in low-carbon energy to fossil fuels needs to reach a minimum of 4 to 1 by 2030. From there, the ratio needs to increase to 6 to 10 in the subsequent decade, and 10 to 1 afterward. In 2021, Bloomberg research found that for every dollar spent supporting fossil fuels, 0.8 supported low-carbon energy. JPMorgan’s estimated ratio was 0.7.

A JPMorgan spokesperson said it would take time to figure out how best to disclose the metric investors are asking for.

“We found common ground with the NYC Comptroller on disclosing a clean energy financing ratio with an understanding that it is going to take us some time and resources to develop a decision useful approach,” said a spokesperson in a statement to Fortune. “We will engage with NYC and our shareholders to provide the market more clarity and transparency about our activities and what financing the transition truly looks like.”

The bank in 2021 announced a $1 trillion target to finance initiatives to help foster the transition to a low-carbon economy. However, the funds pointed out in their proposal that JPMorgan offers more financing to fossil fuels than other banks, ponying up $434 billion since 2016, despite a commitment to achieving net-zero emissions by 2050, said the NYC funds.

The move comes just weeks after J.P. Morgan Asset Management and State Street were roundly criticized for leaving the Climate Action 100+, a coalition of investors focused on working collaboratively to target the companies that are also the heaviest emitters of greenhouse gasses. Since then, Pacific Investment Management Company (Pimco) announced that it would also depart the group, bringing the total assets under management that have departed to $19 trillion. (BlackRock shifted its participation in C100+ to BlackRock International.)

The asset management firms pointed to their independence in withdrawing from C100+, noting that the group was previously focused on agitating for clearer disclosure and not seeking specific action from. That strategy is set to change with the second phase strategy this year. It also coincides with a movement toward anti-ESG proposals and rhetoric that have led conservative groups and politicians to criticize financial services firms for catering to “wokeness” to the detriment of financial returns.

A Climate Action spokesperson told Fortune that antitrust laws aren’t meant to stop investors or companies from working together on goals found not to be anti-competitive “that they have each independently decided is in their interest.”

The group cited an analysis from the Columbia Center on Sustainable Investment that found that antitrust law was having a chilling effect on “necessary private-sector action to address climate and other sustainability-related challenges.”

The Wall Street Journal reported this week that BlackRock has abandoned the term “ESG” from its public statements and that CEO Larry Fink isn’t using it in his annual letters anymore. Instead, “transition investing” is the new work-around for talking about ESG, the Journal reported.

Still, regardless of the words companies use to discuss it, investors—particularly pension funds—remain focused on climate-change risk and engaging with companies on their net-zero commitments. In 2023, there were a record 643 environmental or social related shareholder proposals filed at public companies, a high-water mark that is expected to persist in 2024, according to a report from investor advisory firm Institutional Shareholder Services.

Climate change-related issues are expected to generate the most proposals from shareholders to companies, the ISS report found, and some investors are asking financial services firms to report any misalignment between client greenhouse gas emissions and 2030 net-zero targets.

Source link